I have hundreds of web clients over the years and the vast majority of them simply write me a check when their monthly invoice arrives, however a few have ventured into using PayPal instead. Just today I received a text message from a digital marketing agency about my latest invoice, and they were paying me with something new called Popmoney.

I quickly went and did a Google search to find out if Popmoney was legitimate and then to further understand how it was different from PayPal. So Popmoney is a legitimate new company started several years ago and a wholly owned subsidiary of Fiserv, Inc. To receive my first payment from the client I had to:

- Create a free account at www.popmoney.com

- Have a verification code texted to my phone number

- Add my Wells Fargo Bank account credentials

Here’s the text exchange on my phone:

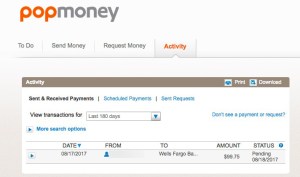

Setting up my account at Popmoney took a few minutes and was straightforward:

How is it different from PayPal? Well, with PayPal I receive a payment from a client, then I have to login to PayPal and then transfer that money into my Wells Fargo Bank account. With Popmoney the money is transferred directly from the client bank account to my bank account, so it never sits at Popmoney, which means that it is more efficient than PayPal is.

To send or request money with Popmoney there is a fee paid by the sender:

There are many competitors to PayPal, however this is the first time that a client has decided to pay me with Popmoney, so maybe it’s a growing trend or just another fad, let’s see what time tells us.